tax preparation fee schedule 2019 pdf

If you enrolled someone who is not claimed as a dependent on your tax return or for. 2 - Supplemental Income and Loss.

Account Ability Form 1098 User Interface Mortgage Interest Statement Data Is Entered Onto Windows That Resemble The Actual Accounting Spreadsheet Irs Forms

Printing fee if you wish paper copies of your returns rather than PDF computer files 55 plus.

. Form 4506 - Request for Copy of Tax Return. Form 1040 ES Estimated Tax Vouchers. 2022 Tax Preparation Fee Schedule Estimate only Effective January 1 2022.

Form 1040 Department of the TreasuryInternal Revenue Service 99 US. Calculate your tax preparation fee for your personal tax return by using this calculator. VITA sites also offer assistance in filing for federal and State Earned Income Tax.

Please note that for the 2021 tax filing season the minimum cost of tax return preparation for Form 1040 starts. Schedule A Itemized Deductions starting at 25. 38 use a fee schedule to charge for tax work.

1545-0074 IRS Use OnlyDo not write or staple in this space. Our tax preparation fees for most individual tax returns is 500 to 700 and corporate tax preparation is generally 800 to 1000. 2019 California Adjustments Residents SCHEDULE CA 540 Important.

Tax preparation fee schedule 2019 pdf Sunday March 6 2022 Edit. Schedule D gains and losses. Amended Returns fees for additional forms may apply 15000.

Schedule EIC - Earned Income Credit. Individual Income Tax Return. 63 rows Rerun charge.

Attach this schedule behind Form 540 Side 5 as a supporting California schedule. Schedule E rental activity. Form 4506-T - Request for Transcript.

View 2019_TaxReturnpdf from GOVERMENT AND BUDGETING MPA620 at Brookline College Phoenix. Do Your 2021 2020 any past year return online Past Tax Free to Try. Part I Income Adjustment.

State Return 80 per state. Schedule A Itemized. Easy Fast Secure.

Schedule B Interest and Dividends 25 per every 5. For tax year 2019 an. Schedule C business activity.

Federal Return up to 4 W-2s 105. Forms 1040540 ES - Estimated Tax. 16 use Intuit ProSeries.

Form 1040 page 1 and 2 not including state return 75. We provide guidance at critical junctures in your personal and professional life. Average Tax Preparation Fees.

There are two programs that offer free assistance. Individual Nonresident Income Tax Return. Vance payments of the premium tax credit were made you must file a 2019 tax return and Form 8962.

Find Forms for Your Industry in Minutes. Schedule K-1 each 2500. Individual Income Tax Return 20 19 OMB No.

Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try. 26 charge hourly for tax work 38 use Thomson Reuters UltraTax CS as their tax preparation software. Applications for extensions to file.

Ad State-specific Legal Forms Form Packages for Legal Services. Form 1040X Amended Tax Return Originally Prepared by Taxlana Inc 20000. Form 1040NR US.

According to a National Society of Accountants survey in 2020 on average you would have paid 323 if you itemized your deductions on your. 150 Each 200 Each Schedule H -. Enter the quantity of forms and check the forms that you need to file and the total amount will be.

EXAMPLE OF FEES - Client with a 350 tax fee estimate. 1040EZ Individual Income Tax Return 8300 1040A Individual Income Tax Return 9400 1040 Individual Income Tax Return 10500 104. Schedule F - Profit or Loss From Farming.

RACs essentially serve as a short-term loan of tax return preparation fees. Form 1040 or 1040-SR line 14 or Form 1040-NR line 27. Streamlined Document Workflows for Any Industry.

The tax filing season opened on schedule January 28 but amid troubling questions and wor-. 35 55 if rush State return. O Can do almost 3 hours of tax and financial planning in Nov or Dec and do an hour of tax prep in May thru Aug and still pay only.

With the knowledge of these. Ad Tax Strategies that move you closer to your financial goals and objectives. Tax Return Fee Schedule.

FORMSSCHEDULE DESCRIPTION FEE PER FORMS. Easy Fast Secure. Taxpayers may rely on the proposed regulations for tax years of beneficiaries beginning after 2017 and before the final regulations are published.

New For 2019 Taxes Revised 1040 Only 3 Schedules

Fillable Form 1040 2017 Income Tax Return Income Tax Tax Return

Profit Loss Statement Templates 6 Free Formats In Ms Word Excel Pdf Profit And Loss Statement Statement Template Business Template

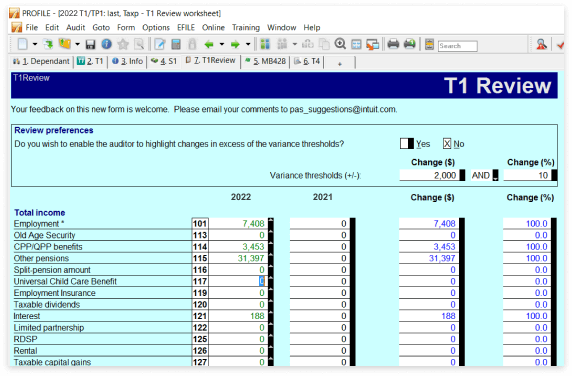

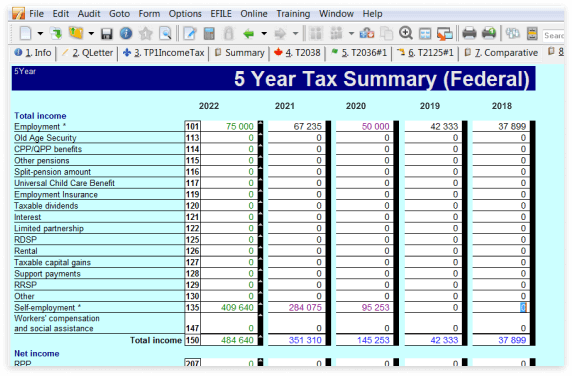

T1 Personal Tax Preparation Cra Efile Software Profile

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Pdf Simple Tax Preparation Checklist Tax Prep Checklist Tax Prep Tax Preparation

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemble The Actu Irs Forms Fillable Forms Tax Forms

T1 Personal Tax Preparation Cra Efile Software Profile

Fillable Pdf Tax Prep Checklist Tax Prep Tax Prep Checklist Tax Checklist